@John Berger I'd like to check out your financial model.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Kia Stinger March Sales Incentives

- Thread starter Kia Stinger

- Start date

MarkyMark

Active Member

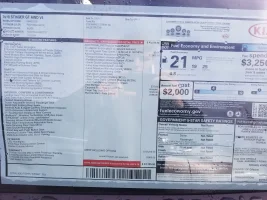

Nice work. There IS a $300 Buyout Fee from KMF that is mandatory. However, some talk to a $650 acquisition fee required by KMF – but I have yet to get a straight answer as to whether that's KMF or a tacked on fee at the dealer level. I'm going to start looking for more answers on this front, far too vague for me right now. But $650 is a healthy chunk of change. Add that to a $300 Buyout Fee and we are around $1k additional. Another way/s for KMF to reclaim as much of that Lease Cash...Thanks Guys! My own financial modelling tells me the increased MF (from .00125 (3%) to .00210 (5%)) on a 36 month lease and the increase in RV (from 52% to 53% raises the monthly lease PMT from a monthly $487 to $531. More importantly, for those considering the lease/quick buyout option, it raises the monthly interest ("rent") component from $85/mo to $144/mo. So each month you wait to pull the trigger on the lease/buyout costs you an additional $59. My calcs are using a $52,000 MSRP, a $50,000 purchase price, no sales tax (here in NH), the (new) $7,000 rebate, a $1,000 downpayment, a $1,000 trade-in allowance, no loan payoff on a prior car, and $500 in assorted dealer/ripoff fees. I'm OK with a general lease rate increase as interest rates have been rising in accordance with the Federal Reserves recent money tightening policies, but 2% on the relative short term of the interest rate curve seems a little excessive. The RV increase of 1% (52% to 53%) seems like an attempt to partially offset the increase in MF and reduction in rebate ($7,200 to $7,000).

Still the conclusion remains the same: Lease it & then buyout the lease contract.

BTW, If anyone wants the EXCEL financial model I created, please let me know and I'll be glad to forward it. Also, if someone more technically adept knows how to upload it as a link on the Stinger website, I'll be happy to provide it for general use.

HTH!

StungBlueGT2

Sustaining Member

I’m 99% sure the $650 acquisition is a standard lease fee from KMF and very similar to most other manufacturer backed financing fees.Nice work. There IS a $300 Buyout Fee from KMF that is mandatory. However, some talk to a $650 acquisition fee required by KMF – but I have yet to get a straight answer as to whether that's KMF or a tacked on fee at the dealer level. I'm going to start looking for more answers on this front, far too vague for me right now. But $650 is a healthy chunk of change. Add that to a $300 Buyout Fee and we are around $1k additional. Another way/s for KMF to reclaim as much of that Lease Cash...

______________________________

MarkyMark

Active Member

Thanks for that, StungBlueGT2.I’m 99% sure the $650 acquisition is a standard lease fee from KMF and very similar to most other manufacturer backed financing fees.

Dave Miller

Stinger Dealer

From interior to exterior to high performance - everything you need for your Stinger awaits you...

Franklin Bing

Member

- Joined

- Feb 19, 2018

- Messages

- 96

- Reaction score

- 47

- Points

- 18

yes. the acquisition fee is a standard fee, it's there for a few reasons but the benefit is that all KIA leases include GAP insurance.I’m 99% sure the $650 acquisition is a standard lease fee from KMF and very similar to most other manufacturer backed financing fees.

NYLAWBIZ

Stinger Enthusiast

Does it cost a dealer to offer a lease over a cash deal? I'm negotiating a buy and at the last minute the dealer wants to charge more for the car because I want to lease it through KMF. Nearly $1,700 more! This is a new one on me. Anyone know anything about this tactic? Thanks.

MarkyMark

Active Member

Yah, shows me he had $1700 in profit in the sale, and not in the lease. So he "could" lease at the buy price (add in lease cash of course) but he had $1,700 more in the deal if you purchased, and he wants that $1,700...Does it cost a dealer to offer a lease over a cash deal? I'm negotiating a buy and at the last minute the dealer wants to charge more for the car because I want to lease it through KMF. Nearly $1,700 more! This is a new one on me. Anyone know anything about this tactic? Thanks.

Tells me he may not be a stair-step volume sales dealer? If the dealer really isn't going after hitting Kia's monthly sales targets (which provide a nice check if hit each month), then the dealer is looking for max dollar per sale. Also, if the dealer's going to hit their stair-step number, and you are just an extra sale, then they will also likely be looking for profit first, not a sales volume figure.

I've thought about the best time to get a deal finalized, working with a stair-step volume dealer of course... Maybe some time around the 20th? A moment when they really want to push to get their number and yet aren't quite sure if they'll it it or not, so push to get the sale? Not sure, but thinking it through...

I'd say work with the online sales guy/gal and engage another Kia dealer, informing them you might be getting some games played and what figure you want for the lease and see what a competitor says. Any chance to steal a sale? Getting competition involved can't hurt!

NYLAWBIZ

Stinger Enthusiast

Oh, I have been doing that. This is the only dealer quoting a higher sales price for a lease than a cash sale. This dealer is advertising a GT@ with a stick of $52,900 for $47,700 (plus $900 in dealer BS fees) for a total of $48,600.

Carlos C

Newish Member

- Joined

- Feb 12, 2018

- Messages

- 12

- Reaction score

- 7

- Points

- 3

Is it a good tactic to negotiate a selling price with the dealer as if you intended to buy the car outright and then once you obtain a good amount off MSRP declare that you want to lease and expect the dealer to honor that price and use it as the initial net cap cost before lease cash is applied?

______________________________

From interior to exterior to high performance - everything you need for your Stinger awaits you...

StungBlueGT2

Sustaining Member

Yes, that is a great strategy for knowing you got a great deal, but a specific payment amount is less important. It’s typically good to start from a selling price(below invoice) and then add incentives like you mentioned. Instead of giving a salesman the lease monthly payment amount in your budget. They would take advantage doing that. Unless of course you already know and can lowball the payment prices by $10-$20m and make them figure out a way to get you close.Is it a good tactic to negotiate a selling price with the dealer as if you intended to buy the car outright and then once you obtain a good amount off MSRP declare that you want to lease and expect the dealer to honor that price and use it as the initial net cap cost before lease cash is applied?

NYLAWBIZ

Stinger Enthusiast

But back to my question, if I may . . . is there a justification for the dealer to quote a higher price for the cap value of the lease, as opposed to the purchase price in an outright purchase? I negotiated a cash deal. Then when I told him I wanted a KMF lease, they updated to the price by juicing the CAP by $1.700!

MarkyMark

Active Member

The only portion I could see raising the price is the $750 purchase rebate. But that doesn't quite cover half of that $1700 more for a lease... I'd look elsewhere.Oh, I have been doing that. This is the only dealer quoting a higher sales price for a lease than a cash sale. This dealer is advertising a GT@ with a stick of $52,900 for $47,700 (plus $900 in dealer BS fees) for a total of $48,600.

Multiple people have said that it's a KMF fee in the past. How much more straight can it get? Lol. I even put a link in about how all manufacturers lease arms have an acquisition fee.Nice work. There IS a $300 Buyout Fee from KMF that is mandatory. However, some talk to a $650 acquisition fee required by KMF – but I have yet to get a straight answer as to whether that's KMF or a tacked on fee at the dealer level. I'm going to start looking for more answers on this front, far too vague for me right now. But $650 is a healthy chunk of change. Add that to a $300 Buyout Fee and we are around $1k additional. Another way/s for KMF to reclaim as much of that Lease Cash...

NYLAWBIZ

Stinger Enthusiast

They backed off, got my deal. I'm now an owner of a red GT2

From interior to exterior to high performance - everything you need for your Stinger awaits you...

StungBlueGT2

Sustaining Member

Congrats and officially welcome to the Stinger “HIVE”They backed off, got my deal. I'm now an owner of a red GT2

______________________________

They backed off, got my deal. I'm now an owner of a red GT2

Hey NYLAWBIZ,

So was your total $48,600 for a GT2 AWD for lease including destination?

NYLAWBIZ

Stinger Enthusiast

Hey NYLAWBIZ,

So was your total $48,600 for a GT2 AWD for lease including destination?

Yep. Include port installed wireless remote plus cargo mat net and wheel locks.

NYLAWBIZ

Stinger Enthusiast

From interior to exterior to high performance - everything you need for your Stinger awaits you...